Penny Wise, Pound Foolish

Having a little extra weight frustrates me immensely. Really, I spend more than 8 hours a week in very strenuous exercise. Tally the 3 or 4 times week I climb mountains on my mountain bike or the 2-3 nights my muscles shake to the point of failure while lifting weights; I still carry some belly fat. I force myself to work on my fitness, but when I look in the mirror, I get discouraged. I feel like I deserve to have no extra cushion on my belly. But I do.

We all struggle with something. I am no stranger to struggling with my diet habits at times. Sometimes I keep a great discipline, but other times I blow it. When I decide to blow my healthy diet, I blow it big. Hand me a bag of Swedish Fish and I'll hand you back an empty bag within an hour. I have, in fact, been able to gain 5 pounds in a single weekend (as I proved when I went to Moab for a mountain biking trip three weeks ago). Removing the weight has taken me the past three weeks.

So, knowing it takes me so long to pay for a short term pleasure, why would I indulge? I suspect it is because I have never fully investigated what a healthy lifestyle really requires: great dietary habits. Someone recently told me that fitness is 80% diet, 20% activity. Crap, I've been spending all this time frustrated because I gave more attention to the least impactful component of good fitness. So, I hired a nutritional coach. I lost 9 pounds the first week of working with Cristy “Code Red” Nickel. I am fully impressed with what she has helped me do. If you are interested in working with a great nutrition coach, contact her. Be warned, she’s a coach, not a pushover. www.cristycodered.com

Managing healthy finances is really no different than managing your personal fitness goals. We start by identifying two components: inflows and outflows. As a Financial Adviser, you can guess I have talked to many people about their views on what affects a health financial household. Most seem to start with the inflows. The more money you make, the better your financial condition can be, right? My answer; no. Rather, the better you control your outflows, the more likely you are to be financially healthy. We all know the stories of lottery winners and their ability to blow millions in a few short years. I could talk about this ad nauseam, but I'll spare you from the obvious.

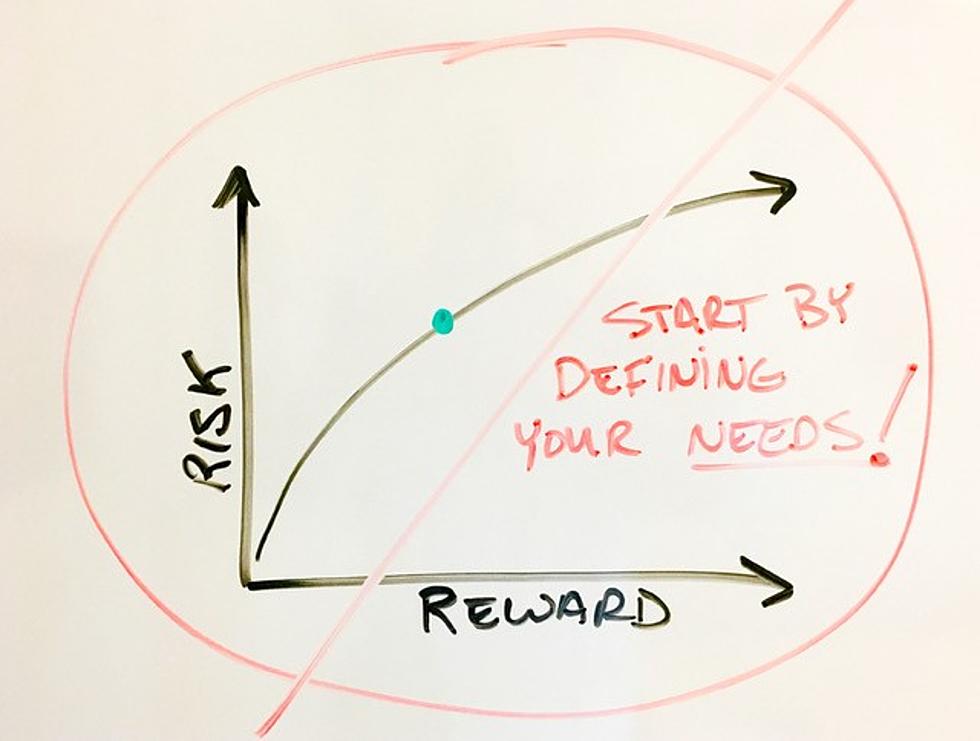

Similar to the fitness formula I mentioned above, I submit this; great financial health is 80% spending habits and 20% income. Excessive debt, like fat on my body, is the result of poor decision making which can be borne from bad habits and/or the lack of financial education and discipline. If we all understood what a few moments of indulgence will do to our long term financial health, we would likely make better decisions. If this resonates with you, then perhaps you might be ready to commit to learning a new way to manage your financial health. My suggestion is to start with education. Here are a few great resources to get you started:

More From Idaho’s Talk Station